In today’s ever-evolving business landscape, digital modernization isn’t just an option; it’s a necessity. But with the vast range of technology solutions available, where do you start?

At SD Digital, we not only grasp the concept of digital modernization, but we also comprehend the needs of the organizations that require it the most. Many businesses face challenges in navigating the market, identifying the right solutions, and optimizing their existing technology investments. That’s where we step in.

Our team empowers organizations with transformative solutions to increase working capital, capture more revenue, reduce costs, and scale efficiently during periods of growth. We help finance teams modernize with impact by driving business model innovation and delivering real, actionable change—not just reports and slide decks.

Micro-Transformations

Implement targeted process improvements to drive incremental yet impactful changes across the business.

ERP Modernization

Align ERP systems with strategic objectives through process visioning, technology enablement and automation to support transformative growth.

Digital Strategy Assessment

Conduct a comprehensive evaluation of digital capabilities, tools, processes and strategies to identify gaps and opportunities, resulting in a prioritized roadmap for change.

AI/ML Strategy

Empower organizations to harness AI and machine learning to drive innovation, enhance decision-making and gain a competitive edge.

Human-Centered Design

Leverage user-focused problem-solving techniques to identify needs, align stakeholders, prioritize challenges and develop high-impact solutions.

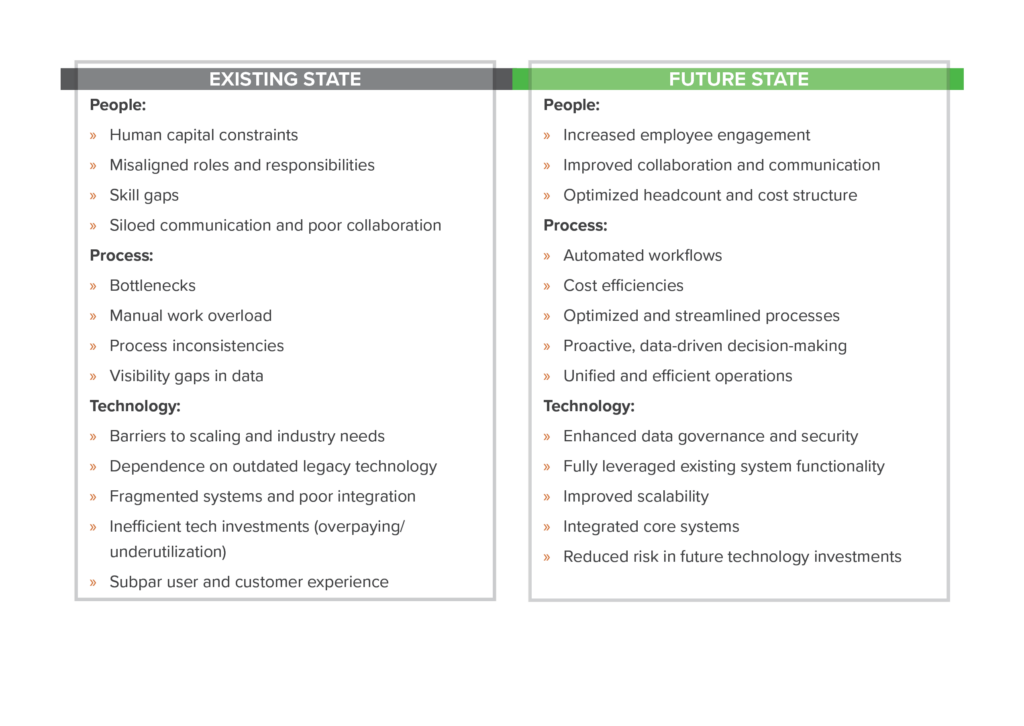

Digital modernization can drive meaningful change at every level of an organization, with the greatest impact on people, processes and technology. While challenges may vary, the signs of needing transformation—and the benefits of doing it right—are often the same. Here’s what success looks like with the right approach.

Guided by AGILE methodology, SD Digital follows a streamlined process to uncover opportunities, redefine possibilities and implement impactful solutions.

Research

Through workshops and analysis, we assess business operations, technical frameworks and areas for efficiency, identifying the best methods to drive transformation.

Ideation

We pinpoint gaps, reimagine the current state, and build a prioritized backlog of capabilities, aligning on a Minimum Viable Product (MVP).

Remediation & Transition

We provide strategic recommendations, establish priorities and deliver a roadmap for future-state implementation.

Our approach ensures clarity, efficiency and a seamless transition toward digital modernization.

SD Digital helps organizations translate technology to transformative change and realize the best version of themselves. With a forward-thinking cap and digital lens, we empower organizations to realize the art of the possible with the power of digital through business-focused and technology-enabled solutions, built on an unwavering commitment to practicality, speed to market and the user experience.

Learn more on our dedicated SD Digital page or contact the team directly at [email protected].

How is digital technology enhancing efficiency, improving accuracy, and enabling smarter decision-making in the construction industry?While the primary objective of…

Read More >One of the best parts of working at Schneider Downs is seeing our consulting practice help clients of all sizes…

Read More >As we set resolutions, close out the previous year, finalize budgets, and kick off new transformational initiatives, the modern-day CFO…

Read More >With only a few weeks remaining in the calendar year (how can this be?!), it’s still not too late to…

Read More >Recently the Pennsylvania Department of Revenue (DOR) published written guidance on the taxability of services related to software and digital…

Read More >A couple of months ago, CDK Global was victim to a cyberattack, prompting them to halt most of their services…

Read More >When calculating Return-On-Investment (“ROI”) for an intelligent automation program, many organizations fail to accurately measure the value the technology provides.…

Read More >I had the pleasure of representing SD Digital’s Intelligent Automation Team at Automation Anywhere’s Imagine 2024 Conference in Austin, Texas.…

Read More >We traveled to Denver earlier this month to attend DynamicsCon. The week was jam-packed with educational sessions, listening to stories…

Read More >Copyright Disclaimer: This article is a repost and not an original work. All rights to the content belong to the…

Read More >The much-anticipated Dynamics 365 Business Central 2024 Release Wave 1 is finally here, bringing with it a host of new…

Read More >For the past few decades, there’s been an emphasis on incorporating more advanced technology into the manufacturing process. This directive…

Read More >A critical task in selecting the right Corporate Performance Management (CPM) solution is ensuring you have the right consulting partner…

Read More >On Monday, October 30th, President Biden signed an Executive Order (EO) on Artificial Intelligence (AI) in efforts to mitigate risks…

Read More >Wow! What a week at Dynamics Community Summit in Charlotte. A short blog post cannot do all the great content…

Read More >All companies are susceptible to cybersecurity attacks; however, this article focuses on some of the main vulnerabilities within the construction…

Read More >Why are so many construction companies still reliant on manual processes? Since investing in enhanced processes and technology most likely…

Read More >We’re excited about the next release of Dynamics 365 Business Central. There are many new features that make the platform easier…

Read More >Moving to Microsoft Dynamics 365 Business Central? Here’s our SmartList of 7 key steps to ensure a smooth transition. Microsoft…

Read More >This past February 23, the IRS published Treasury Decision 9972 requiring filers of 10 or more tax or information returns…

Read More >Email us: [email protected]

Schneider Downs is a Top 60 independent Certified Public Accounting (CPA) firm providing accounting, tax, audit and consulting services to public and private companies, not-for-profit organizations and global companies. We also offer risk advisory, transaction advisory, digital consulting, wealth management, retirement plan solutions and investment banking services. Schneider Downs serves individuals and companies in Pennsylvania (PA), Ohio (OH), West Virginia (WV), New York (NY), Maryland (MD), metropolitan Washington (DC) and additional states in the United States with offices in Pittsburgh, PA, Columbus, OH, and McLean, VA.

© 2024 Schneider Downs & Co., Inc. Maryland license number 35239.

Every moment counts. For urgent requests, contact the Schneider Downs digital forensics and incident response team at 1-800-993-8937. For all other requests, please complete the form below.

"*" indicates required fields