Overview

- Student debt is an expanding liability.

- Understanding your loan options, interest rates, and terms are key.

- Is college worth it? What are important planning considerations?

Current Finances Facing College Freshmen

Looking at the college graduating class of 2019, 69% of graduates had student debt with an average balance of roughly $30K. In addition, according to a study by New America (a nonprofit, nonpartisan think tank), the average interest rate on this outstanding student debt is roughly 5.8%, implying an average annual interest on student debt of roughly $1,700 per year before graduates even begin to pay down principal. With current outstanding student debt of roughly $1.7 trillion, up from $480 billion in 2006 with a nearly 9.5% annual increase, it is clear that student debt planning is a key financial planning topic.

How Does the Process Work? Student Loan Types

Many students rely on the Federal Government for school loans, for which they may be eligible for any of the following: subsidized, unsubsidized, and PLUS loans. If a student is not eligible for Federal Government school loans, or those loans do not cover their full tuition balance, students may apply for private loans. The main differences between subsidized and unsubsidized loans are that students must demonstrate a financial need to qualify for a subsidized loan.

Direct Plus loans are only available to graduate/professional students and parents of dependent undergraduate students.

- Federal Direct Subsidized Loans allow students that qualify for financial aid to borrow money for school payments with the Department of Education covering one’s interest while enrolled at least half-time in school. Direct subsidized loans have a relatively low-interest rate of around 2.75%. The downside to subsidized loans is their relatively low cap, which was $3,500 for 2020-2021.

- Federal Direct Unsubsidized Loans are offered to undergraduate and graduate students without a demonstrated financial need. Consistent with subsidized loans, unsubsidized loans offer an attractive interest rate of 2.75%. However, unsubsidized loans also have a low cap relative to the aggregate cost of a college education. In addition, the interest on an unsubsidized loan begins accruing as soon as the loan is made.

- Federal Direct PLUS Loans are for graduate/professional students or the parents of undergraduate students. The benefit of PLUS loans includes no specific caps on loan amounts. However, the typical maximum for PLUS loans is the school’s cost of attendance (i.e. tuition and fees, room and board, books and other supplies) less other financial aid received. Students will want to max out subsidized and unsubsidized loans prior to a PLUS loan given their higher interest rate of 5.3% and higher origination fees.

- Private Loans are loans that students should only consider after exhausting all of the above federal loan options. When applying for a private loan, financial institutions will evaluate the student’s credit quality (i.e. credit score and history) and offer financing terms accordingly. Typically, the terms on private loans will not be as lenient or as favorable as the above federal loan options.

Is college worth it?

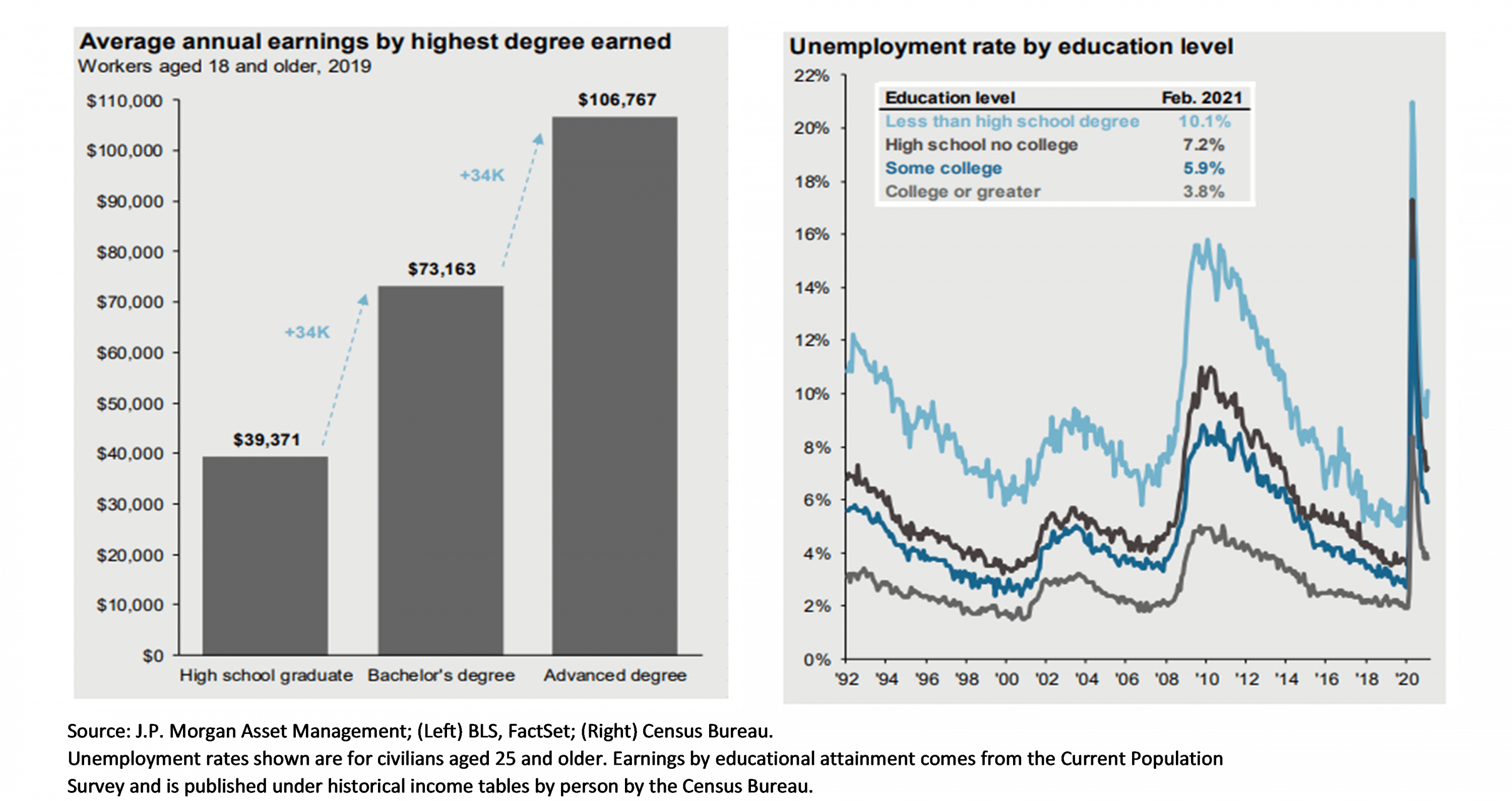

We will not be going in-depth on the recent “Is college worth it?” debate, but the data below makes a compelling case for the very positive impact of a college education on an individual’s long-term earnings potential in the workforce. As illustrated in the charts below, the average earnings and unemployment data for college-educated individuals paints a favorable picture relative to high school-only graduates. There is a caveat to the debate about whether to attend college or not.

What is the caveat?

The trick to navigating the college finance question is a clear understanding and plan for education prior to enrollment. Key college planning considerations include:

- Major and Future Earnings Potential – What do you plan to study and what is the long-term earnings potential of that field of study? See this article by Indeed.com, comparing starting salaries by college major and industries, respectively.

- Community College for General Education Classes – This option can be a great way to cut down on the overall price of college, particularly for the general education classes most colleges require. According to the American Association of Community Colleges, for the 2019-20 academic year, average annual tuition and fees at community colleges were $3,730, compared to $10,440 average annual tuition and fees at public four-year institutions.

- Consider Trade School – Trade schools focus on teaching skills and abilities directly related to a specific job such as electrician, plumber, and HVAC technician. Given the lower cost of trade school education, paired with the expected increasing demand for skilled labor, trade schools are increasingly becoming an excellent choice for students looking to forego large student debt balances while securing employment with a living wage.

As student debt balances continue to balloon, having a plan in place coupled with a clear long-term vision is crucial in effectively managing student debt obligations. If you have questions about managing student debt that you’ve already incurred or are preparing for a child or grandchild to go to college, please reach out to one of our Schneider Downs Wealth Management Advisors.