For most people, the largest asset they own is their qualified retirement plan. For some, this account may be in the “accumulation” phase for 40 years or more; for others, the account maybe in the “distribution” phase, which may last 30-40 years. The point is, your retirement account is not intended to be a short-term asset. Investing involves risk, and with risk comes the potential for loss. With recent events, the Coronavirus has caused the markets to become panicked, resulting in a great deal of volatility.

During stressful and uncertain times like these, the natural human inclination is to flee the markets and resort back to a cash position of safety. It can be hard to stay disciplined and invested in times of uncertainty, particularly when it seems like there is no end in sight to the market’s downward pressure. The best thing an investor can do is trust their allocation, wait for calm and clarity, reassess the risk tolerance; then, if needed, make a change to their portfolio allocation.

Unfortunately, it often requires events like COVID-19 to help investors identify their own risk tolerance. With uncertainty over the long-term impact of the virus, we remain optimistic that the pessimism around the markets will pass.

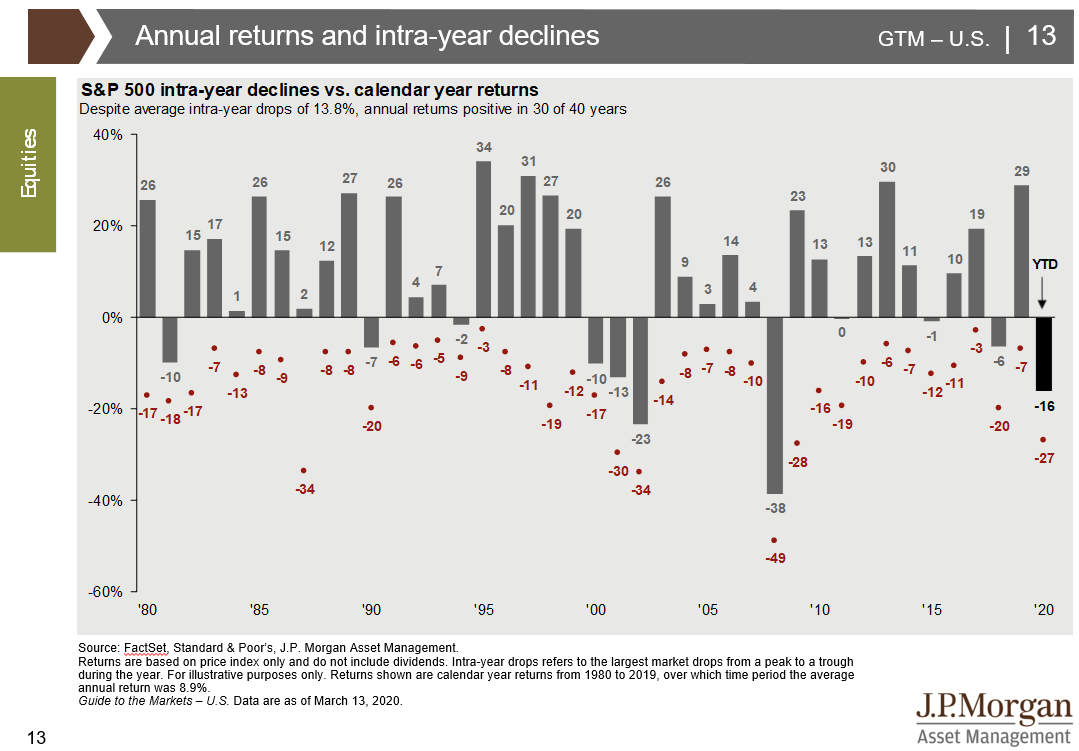

The charts below, produced by JPMorgan, can add some perspective. The first, titled “Annual returns and intra-year declines,” shows calendar year returns and the intra-year decline of the S&P 500 dating back to 1980. On average, we experience a 13.8% decline each year, with 30 of 40 years of annual returns ending positive.

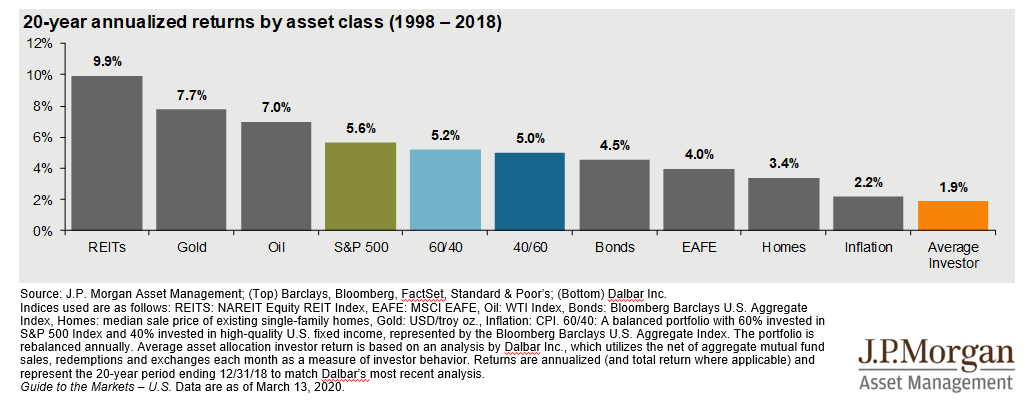

The second chart, titled “20-year annualized returns by asset class (1998-2018),” displays the returns of major asset classes and the returns of the average 60/40 investor. Due to poor decision making, the results show that the average investor far lags that of the major asset classes.

In the design and construction of SDMWA’s six (6) risk-based models, we considered the long-term aspect of the asset and plan for the extreme stress the markets can place on account balances in the short term, as well as achieving sufficient accumulation as the larger long-term goal.

We often tell people: “Investing is like surviving a hurricane. You prepare before the storm, hunker down during the storm, and then, evaluate the damage after the skies have cleared. But never go out in the middle of it in and attempt to secure items.” We recommend before you make any changes to your strategy during this volatile time, you pause and reach out to us.

We stand ready to assist and answer questions and concerns you might have.

Schneider Downs Wealth Management Advisors, LP (SDWMA) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). SDWMA provides fee-based investment management services and financial planning services, along with fee-based retirement advisory and consulting services. Material discussed is meant for informational purposes only, and it is not to be construed as investment, tax or legal advice. Please note that individual situations can vary. Therefore, this information should be relied upon when coordinated with individual professional advice. Registration with the SEC does not imply any level of skill or training.

Related Posts

No related posts.