Recently the Wall Street Journal published an article titled, “Rich Millennials to Financial Advisers: Thanks for the Golf Invite, But You Can’t Invest My Money”, noting that young, wealthy investors don’t see the value in working with an advisor, preferring to pick their own investments such as individual stocks and cryptocurrency. As a wealth management practice that prides itself on client service and forming personal connections, we wanted to respond with our thoughts regarding Millennial clients, defined as individuals born between 1981 and 1996.

Self-Managed to Start the Round

As noted in the article, according to Federal Reserve data analysis from 2019, roughly 70% of households with a net worth of $500K or more, headed by a person under 45 years old, were mostly self-directed investors. Nearly half of these households were aiming to take an above-average level of risk with the expectation of earning above-average returns.

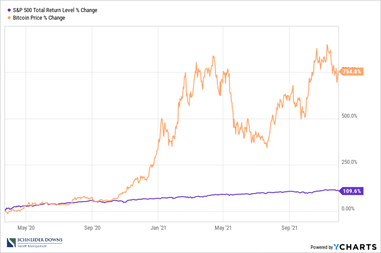

When we layer in the tremendous market rebound that we’ve seen since COVID-19 capital market lows on March 23, 2020

(see chart):

- The S&P 500 is up almost 110% on a total return basis (including dividends) thru November 30, 2021; and

- The price of Bitcoin is up a tremendous 750%+ over the same time. See Jason Staley’s article, “Bitcoin, Bitcoin, Read All About It” for additional cryptocurrency commentary.

Given the recent run-up in traditional capital markets and speculative cryptocurrency investments, it proves to us that Millennials, initially, are electing to “carry their own golf clubs” regarding their investment management.

Dalbar Study Highlights Long Term, Self-Management Challenges

However, long-term research continues to illustrate the value of having a trusted, third-party advisor.

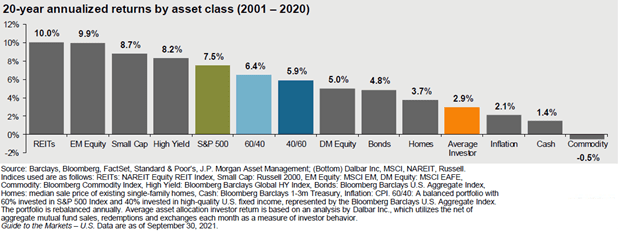

Since 1994, Dalbar, Inc. (“Dalbar”) has measured the effects of the “average investor” and their decisions to buy, sell, and switch in and out of investments over various periods of time. Dalbar utilizes the net aggregate mutual fund sales, redemptions, and exchanges each month as a measure of investor behavior.

According to Dalbar, the average investor, for the 20-year period ending December 31, 2020, earned 2.9% per year relative to the S&P 500 Index, up 7.5%, and to the Barclays Aggregate Bond Index, up 4.8%, over the same time period.

As we’ve written about before in our article on behavioral investing challenges, behavioral finance has illustrated that individual investors tend to make poor investment decisions because of personal biases and emotions resulting in sub-optimal investment performance. This is an area in which a trusted advisor can really add value for millennials long-term.

(For more information on effective ways to minimize personal biases that impact investment results, see our videos on Disciplined Investment Approach and Importance of a Financial Plan.)

Financial Advice Later in Life

As Pew Research Center studies indicate, compared to other generations, the financial well-being of Millennials can be complicated.

- Higher Debt Burden – The share of young adult households with any student debt doubled from 1998 (when Gen Xers were ages 20 to 35) to 2016 (when Millennials were that age). In addition, the median amount of debt was nearly 50% greater for Millennials with outstanding student debt ($19,000) than for Gen X debt holders when they were young ($12,800).

- Living At Home Longer – In 2018, 15% of Millennials (ages 25 to 37) were living in their parents’ home. This is nearly double the share of early Boomers and Silents (8% each) and 6 percentage points higher than Gen Xers who did so when they were the same age.

- Marrying Later – In 1968, the typical American woman first married at age 21 and the typical American man first wed at 23. Today, those figures have climbed to 28 for women and 30 for men.

The above data paints a picture that asset accumulation for Millennials is likely delayed.

Club Selection Still Key When It Matters

An underappreciated aspect of wealth management is not only generating wealth, but also keeping one’s wealth. According to the National Endowment for Financial Education, about 70 percent of people who win a lottery or receive a large windfall go bankrupt within a few years. To us, this continues to illustrate the value of a trusted, long-term advisor advocating for prudent, thought-out financial decisions.

While Millennials may not be receptive to the industry’s golf invitations today, we still expect them to eventually want the guidance of a trusted caddy, it just might not be until the back 9.

The Journal article notes that a financial advisor is still important at any age and stage of life, such as for the individual that partially monetizes his advertising agency for $9 million or the individual that is working through a complicated estate. As income, assets, and families grow, the need and desire for holistic wealth management services (i.e., investment management, tax planning, and overall estate planning) for Millennials, in our opinion, will remain consistent with previous generations.

If you have questions about this article or are curious about whether you need wealth management services, please reach out to us at sdwealthmanagement@schneiderdowns.com and we will connect you with one of our trusted advisors.

Schneider Downs Wealth Management Advisors, LP (SDWMA) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). SDWMA provides fee-based investment management services and financial planning services, along with fee-based retirement advisory and consulting services. Material discussed is meant for informational purposes only, and it is not to be construed as investment, tax or legal advice. Please note that individual situations can vary. Therefore, this information should be relied upon when coordinated with individual professional advice. Registration with the SEC does not imply any level of skill or training.