Can working with a financial advisor lead to greater happiness? A recent industry survey strongly suggests that yes, individuals and couples are happier when working with a financial advisor compared to similar consumers who do not engage an advisor by an almost 2-to-1 margin.

In its 2021 Consumer Financial Behaviors Study, Herbers & Company asked 1,000 people around the country about their levels of happiness. Respondents had to self-report assets equal to or greater than $250,000. 54% of respondents were male, and 79% of total respondents reported that they were married or living with a significant other.

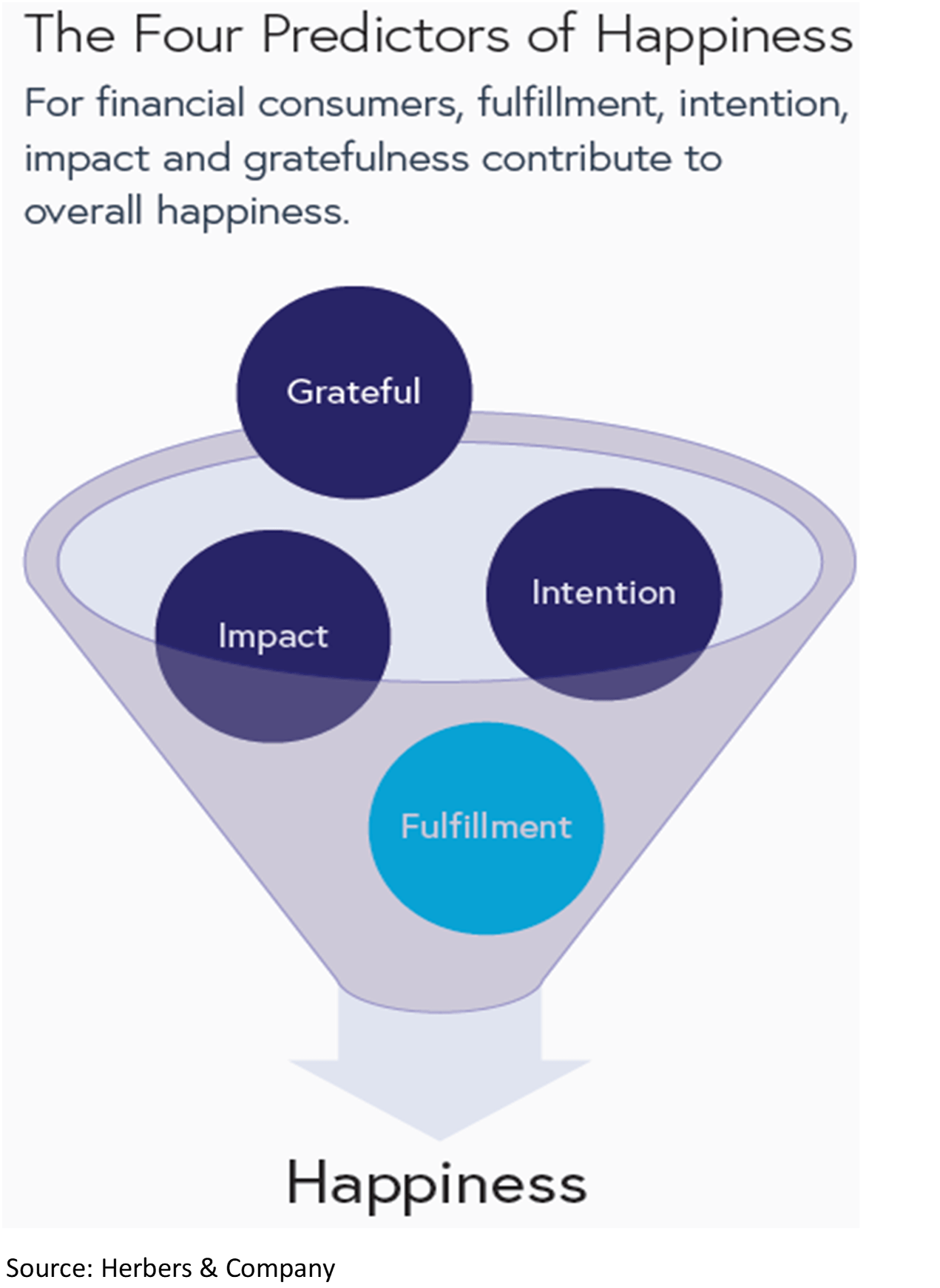

Four Predictors of Happiness

Herbers’ study defined happiness as the feeling that reflects how well individuals’ needs are being met, including a person’s emotional, mental, physical, and relational needs. The financial impact on happiness from money was due to a person’s ability to meet their needs and those of their families. Researchers identified four core factors that make people happier, with all four of those factors heightened among the 66% of consumers who work with a financial advisor versus 34% who do not:

- Fulfillment

- Intention

- Impact

- Gratefulness

Based on this study, people who hire a financial advisor were statistically happier than those who did not—by a wide margin. This held true even when controlling for gender, age, income, and asset levels.

As Household Assets Grow, Advisor Impact Expands

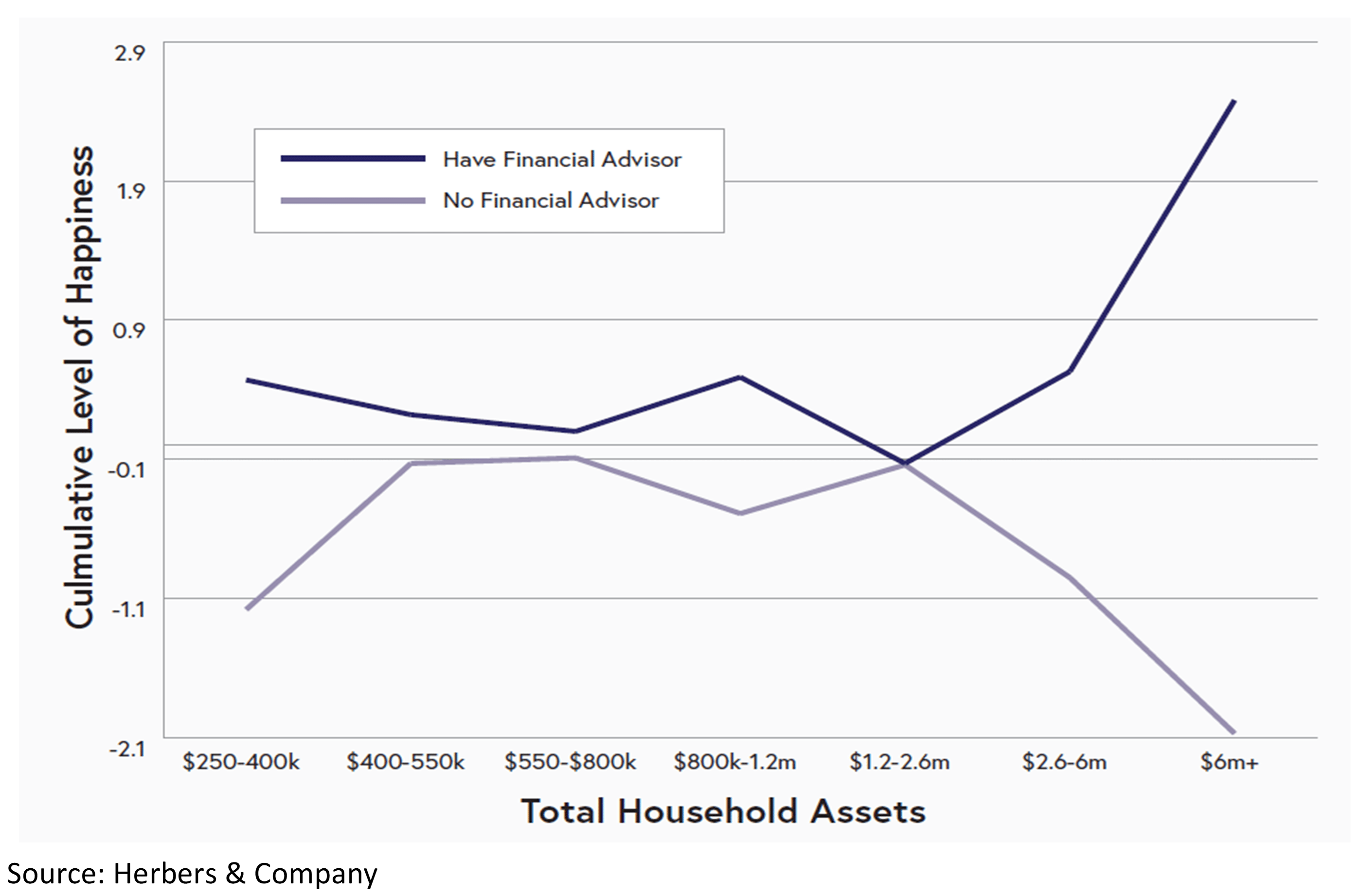

The happiness of individuals and the positive impact of a financial advisor amplify as assets grow.

The Herbers & Company research identified $1.2 million of total household assets as a critical crossover point, where the divergence of consumers’ happiness with and without a financial advisor begins to accelerate as noted in the chart.

Beyond the $1.2 million point, the comparable happiness of consumers working with a trusted advisor is even more magnified.

“Why” Increased Happiness with Advisor

As a firm that focuses on establishing meaningful lifelong relationships with clients by delivering personalized, multi-disciplined wealth management solutions, we wanted to elaborate on the “Why” to client happiness when working with a trusted financial advisor.

From a client point of view, with assets of $1M+, the financial implications of their personal finance decisions become amplified from a dollar amount. The perspective of a trusted advisor who has a complete understanding of their long-term financial goals becomes more important as assets grow.

At the $5M+ asset level, client desire for long-term, holistic financial planning advice (investment management, estate, and tax planning) increases significantly in our experience, which is consistent with Herbers’ survey.

In our view, the benefits of a financial planning-focused advisor to clients with $1M+ of assets comes into focus in preparing a long-term financial plan together. During the process, the client(s) and advisor discuss and clarify long-term goals such as retirement age and desired spending, retirement picture (i.e. 2nd home), or philanthropic goals, as some common client examples.

Working through the financial planning process, a trusted advisor should foster open financial dialogue between couples, that in our experience typically does not naturally occur, if not for an advisor encouraging the conversation.

The financial dialogue that naturally occurs in evaluating and establishing financial goals, paired with an execution strategy to achieve one’s long-term financial goals, drives financial clarity.

Long-term financial clarity is the ultimate client goal, and with clarity comes financial peace of mind and long-term happiness.

To hear more about our experiences with clients and providing them long-term financial clarity, please see the video below for a conversation between Investment Relationship Manager, Alissa Garcia, CEO, Nancy Skeans, and Managing Partner, Derek Eichelberger.

If you would like to speak with a Schneider Downs Wealth Management Advisor, please contact us at [email protected].

Schneider Downs Wealth Management Advisors, LP (SDWMA) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). SDWMA provides fee-based investment management services and financial planning services, along with fee-based retirement advisory and consulting services. Material discussed is meant for informational purposes only, and it is not to be construed as investment, tax or legal advice. Please note that individual situations can vary. Therefore, this information should be relied upon when coordinated with individual professional advice. Registration with the SEC does not imply any level of skill or training.

Related Posts

No related posts.