The Tax Cuts and Jobs Act of 2017 (TCJA) impacted nearly every U.S. taxpayer both in personal income tax filings, and indirectly through the changes in corporate tax reform. As the IRS continues to issue regulations and guidance for the proper treatment for the many law changes, the Financial Accounting Standards Board (FASB) has also revised the guidance on accounting for income tax under ASC 740 as a result of the TCJA. As the guidance is issued, we will provide Our Thoughts On the accounting considerations and impact of the TCJA.

This article discusses how the changes related to Net Operating Loss (NOLs) can impact the recording of the deferred tax asset (DTA) and any potential need for a valuation allowance. For NOLs generated in tax periods beginning before January 1, 2018, there was no income limitation on future use, but they were subject to an expiring statute of 20 years. Under the TCJA, for losses generated after December 31, 2017, corporate NOLs can now be carried forward indefinitely; however, they are subject to an 80% limitation on taxable income. While this has an obvious impact on a corporation’s calculation of its tax liability when using a NOL that was generated in a tax period beginning after December 31, 2017, accounting for the future utilization can have unforeseen complexity.

When a NOL is generated in a tax period beginning after January 1, 2018, the corporation will record a deferred tax asset no different than previous treatment. However, with changes in expiration (indefinite carryforward) and potential income limitations, further consideration needs to be given when determining the amount of a valuation allowance, if any, that should be recorded against this DTA. For starters, if a corporation has an indefinite-lived intangible, this may now be used as a potential source of taxable income against the indefinite-lived NOL with consideration being given to the 80% income limitation. Additionally, with the NOL having a limitation on use, a rollout of the corporation’s utilization of all DTAs and deferred tax liabilities (DTLs) is required to determine the timing of estimated use as it can be possible that the corporation’s DTLs will reverse in a period where the NOL will be limited in use which requires a potential deferred tax liability be recorded when the corporation may have a net DTA before valuation allowance.

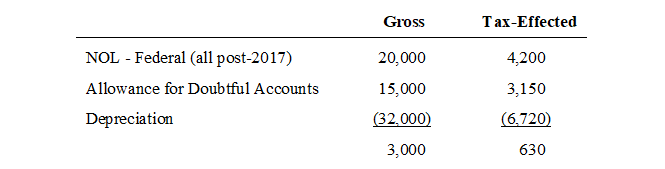

The following example illustrates these complex rules. Suppose a corporation has the following deferred tax assets and liabilities at the end of 2019 before any consideration of recording a valuation allowance, while taking no consideration at this time for state impact:

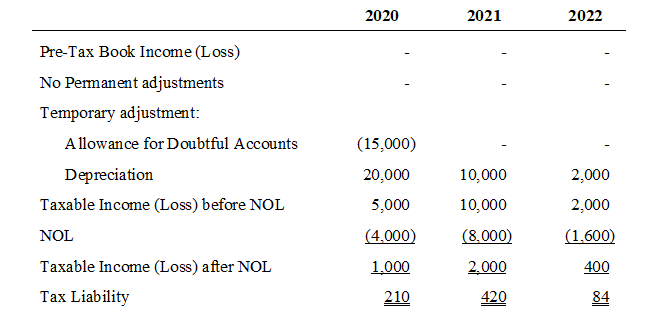

Now suppose that the Corporation is in a three-year cumulative loss and it is more-likely-than-not that the Corporation will not be able to utilize the net DTA recorded and therefore must record a full valuation allowance. For simplicity, assume the Company has zero income before taxes and no permanent items. Prior to tax reform, the impact of the valuation allowance would eliminate the net DTA on the balance sheet. There would be $630 that is recorded in the current year as Valuation Allowance expense which is a component of deferred tax expense. Under the new rules for post-2017 NOLs, the Corporation must forecast the timing of the reversals to determine the valuation allowance that must be recorded. Assume the forecast for the reversals of the deferred assets/liabilities as follows:

The reversals of depreciation and allowance for doubtful accounts generate taxable income and can only be offset by the available NOL subject to the 80% taxable income limitation. According to ASC 740-10-55-36, the limit on utilization of a NOL must be considered when determining if it is more-likely-than-not that some, or all, of the DTA will not be realized.

In the above example, the reversals of the DTLs will be used as a source of income to utilize the corporation’s DTAs; however, due to the timing of the reversal, the corporation has forecasted that NOLs will remain with no available DTL to offset. A valuation allowance is required to be recorded for the remaining NOL expected to be more-likely-than-not to be utilized. Therefore, this would require that a valuation allowance be recorded for $1,344 ($20,000 NOL available, less the $13,600 utilized, times 21% tax rate) which would create a net DTL of $714 (Tax-effected net DTA before valuation allowance of $630, less valuation allowance of $1,344).

Accounting for income tax has continued to be a leading cause for financial restatement. With further guidance and requirements on accounting for tax reform, the complexities within ASC 740 have only increased. To inquire further and to receive Our Thoughts On accounting for tax reform, please email us at [email protected].